1 LP spot left this month

Build with

Second Bridge

Trusted by investors at

"the Second Bridge Team operates at the intersection of world-class execution and unparalleled trust. I couldn't ask for better partners"

About us

About us

About us

a team of world-class execution

We specialize in acquiring, developing, and operating high-quality investment opportunities that deliver strong returns. From ground-up construction projects to high-performing rental assets, our focus is on creating resilient portfolios for our limited partners.

With deep expertise in acquisitions, development, and operations, we take pride in executing every deal with precision, transparency, and care. Our mission is simple: align with investors, communicate with clarity, and deliver results that stand the test of time.

$0M

$0M

Assets Under Management

Over 8-Figures worth of assets owned in our portfolio

$0M

$0M

Assets Under Management

Over 8-Figures worth of assets owned in our portfolio

$0M

$0M

Assets Under Management

Over 8-Figures worth of assets owned in our portfolio

10

10

Unit Portfolio

Mix of New Construction Units, Single-Family Homes, & Rental Investments.

10

10

Unit Portfolio

Mix of New Construction Units, Single-Family Homes, & Rental Investments.

10

10

Unit Portfolio

Mix of New Construction Units, Single-Family Homes, & Rental Investments.

0

0

Yrs of Collective Experience

acquiring, operating, and exiting real estate investments.

0

0

Yrs of Collective Experience

acquiring, operating, and exiting real estate investments.

0

0

Yrs of Collective Experience

acquiring, operating, and exiting real estate investments.

0%

0%

Client satisfaction

All of our clients are satisfied with our work and service

0%

0%

Client satisfaction

All of our clients are satisfied with our work and service

0%

0%

Client satisfaction

All of our clients are satisfied with our work and service

Past Projects

Past Projects

Past Projects

Our Track Record Speaks for Itself

See how we've transformed the lives of our investors. Our performance speaks for itself.

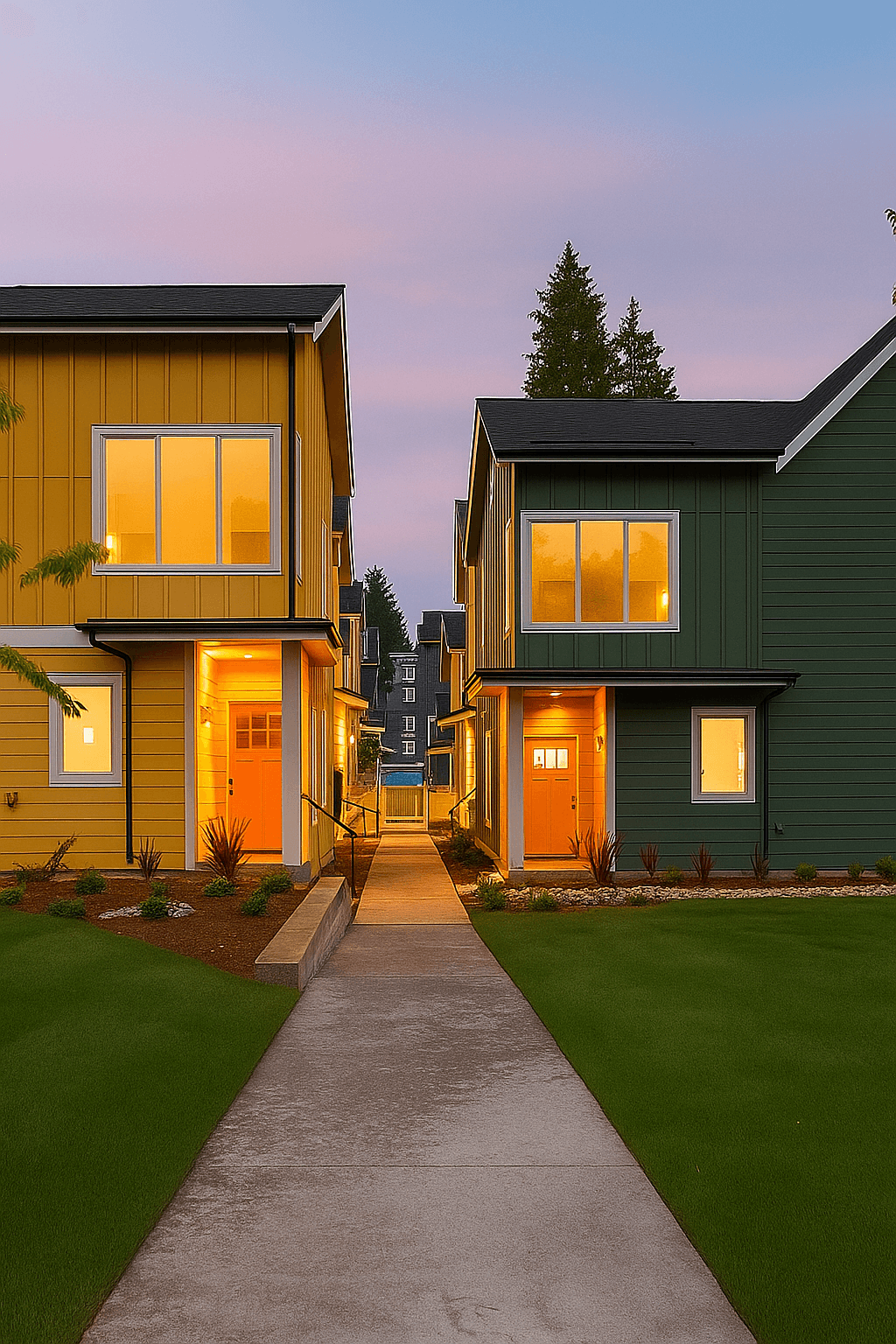

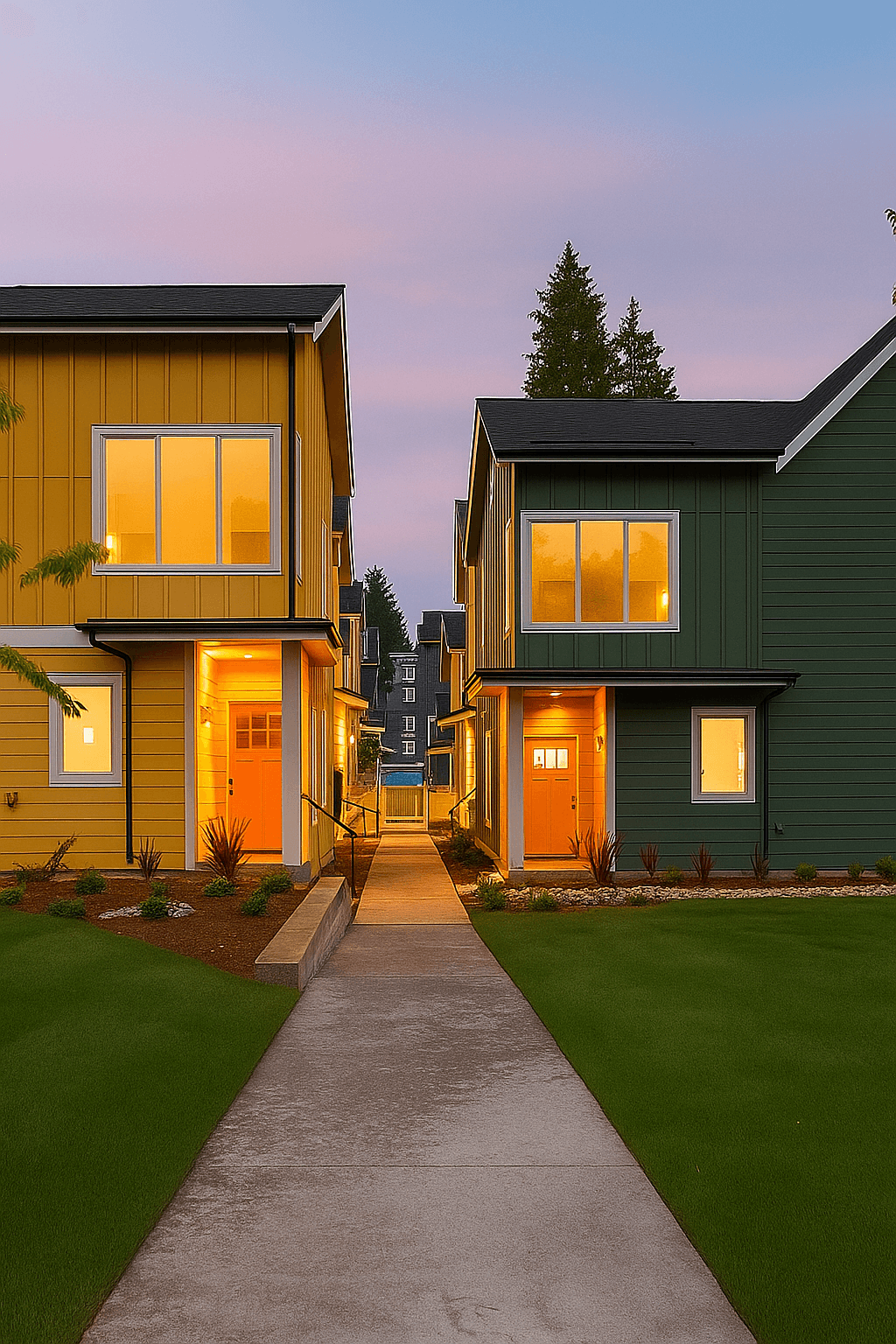

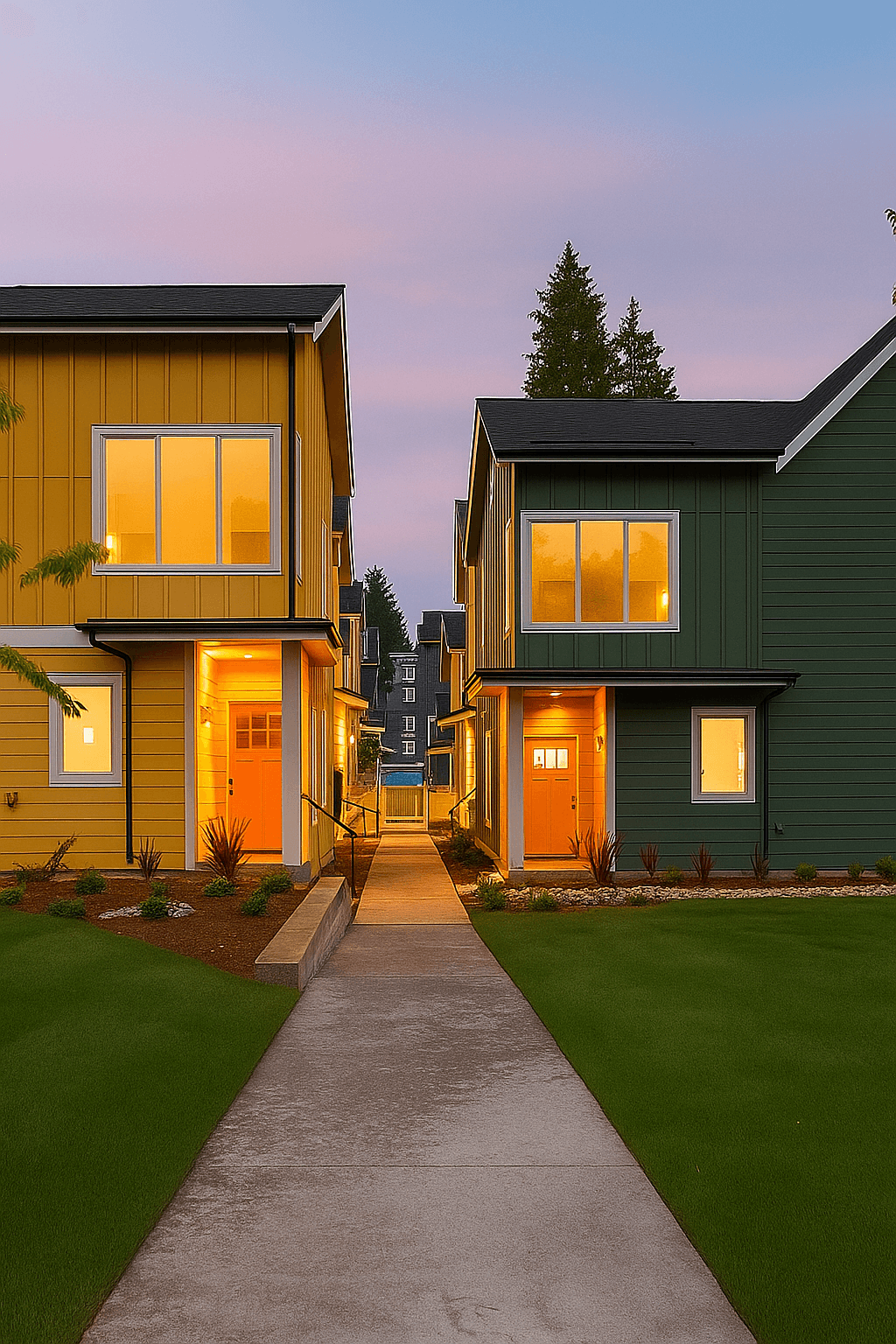

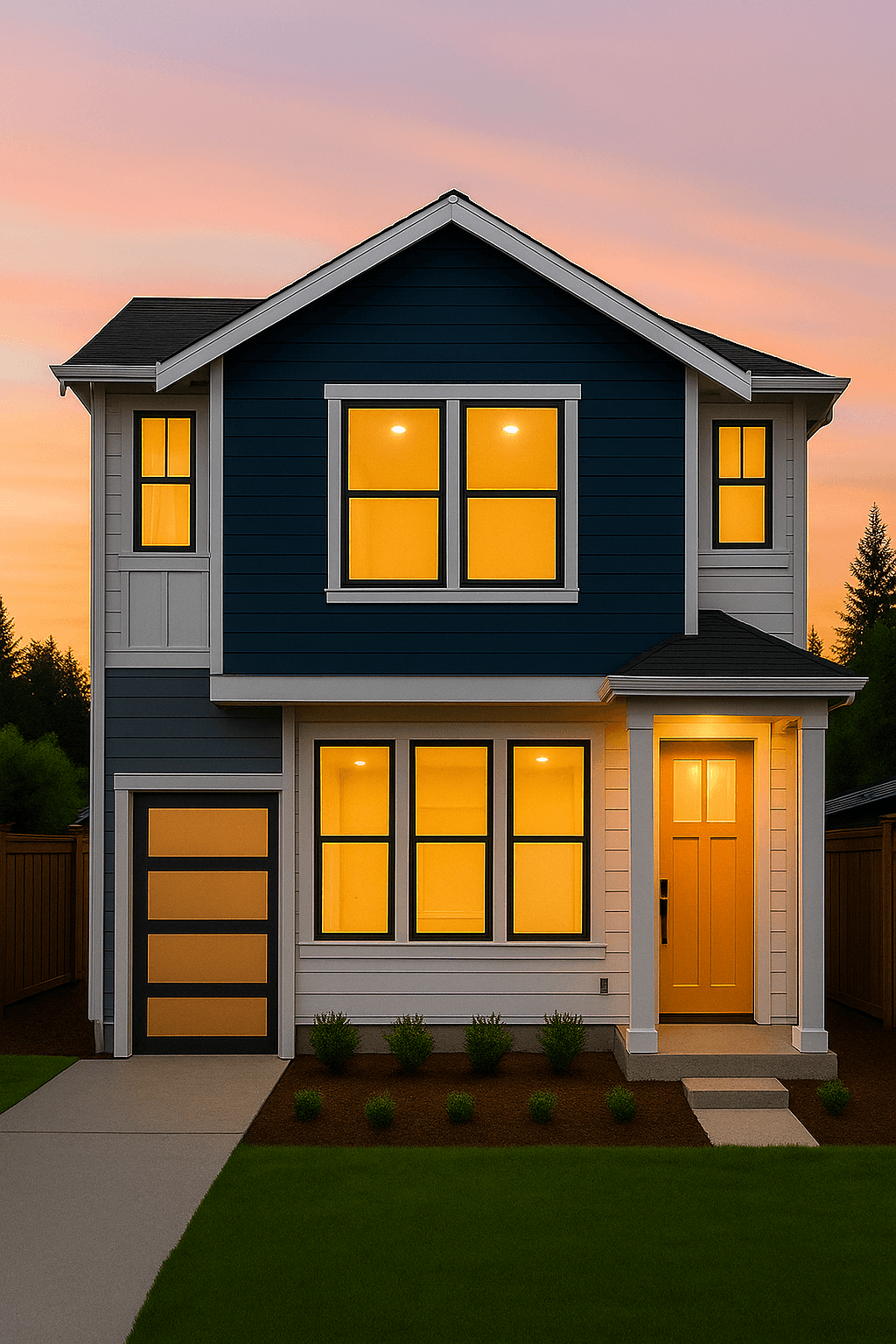

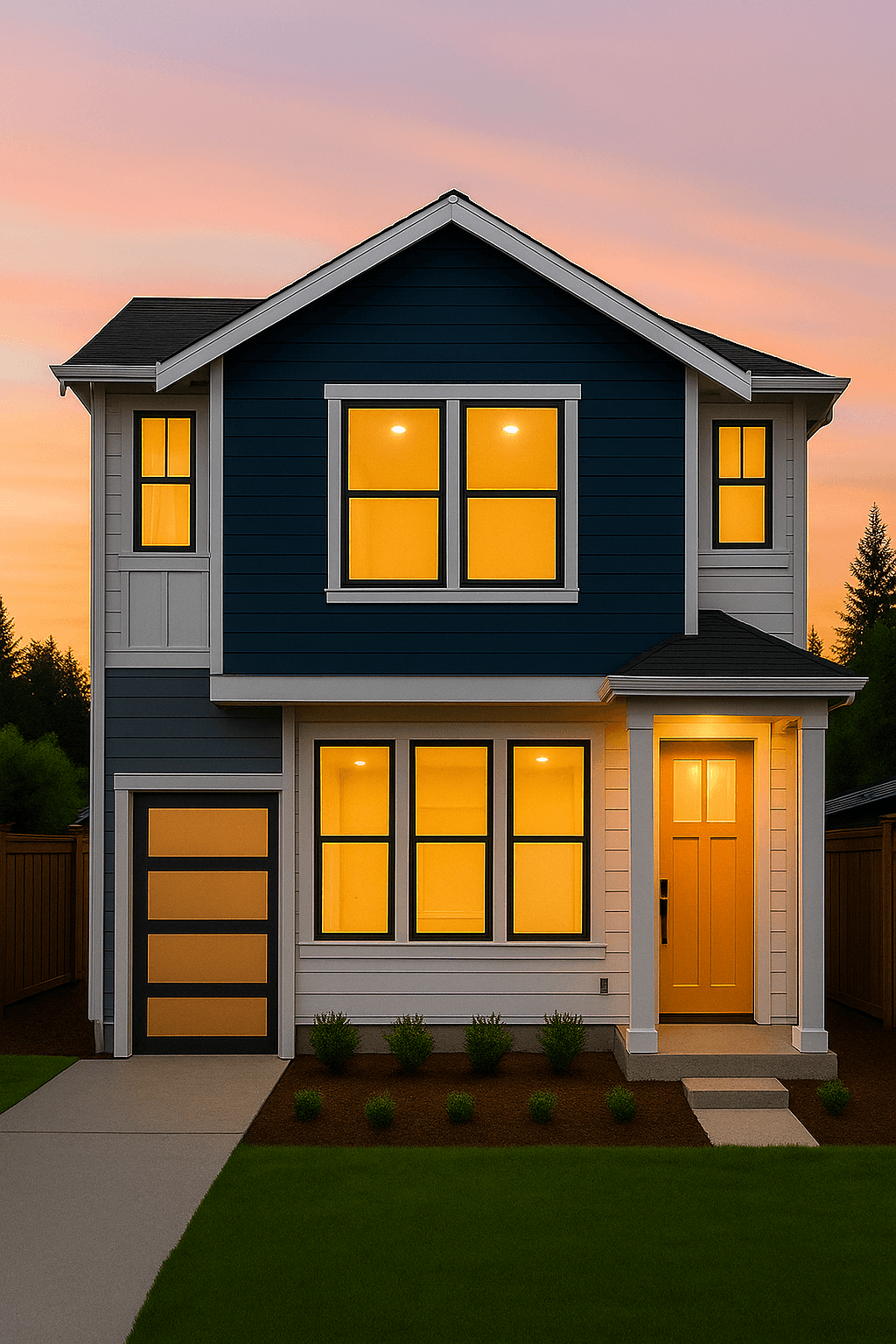

2-Unit New Construction

We acquired an off-market single-family home in Seattle’s high-demand Ballard neighborhood, known for its walkability, dining scene, and strong buyer demand. Over 15 months, we worked closely with the City to permit and build two modern new-construction units on the parcel. Our returns? A combined $2.1M exit valuation and a 40%+ investor return

Development

12-15 months

Seeing a 40%+ return in just over a year was incredible — this was one of the easiest, most rewarding investments I’ve ever made.

2-Unit New Construction

We acquired an off-market single-family home in Seattle’s high-demand Ballard neighborhood, known for its walkability, dining scene, and strong buyer demand. Over 15 months, we worked closely with the City to permit and build two modern new-construction units on the parcel. Our returns? A combined $2.1M exit valuation and a 40%+ investor return

Development

12-15 months

Seeing a 40%+ return in just over a year was incredible — this was one of the easiest, most rewarding investments I’ve ever made.

2-Unit New Construction

We acquired an off-market single-family home in Seattle’s high-demand Ballard neighborhood, known for its walkability, dining scene, and strong buyer demand. Over 15 months, we worked closely with the City to permit and build two modern new-construction units on the parcel. Our returns? A combined $2.1M exit valuation and a 40%+ investor return

Development

12-15 months

Seeing a 40%+ return in just over a year was incredible — this was one of the easiest, most rewarding investments I’ve ever made.

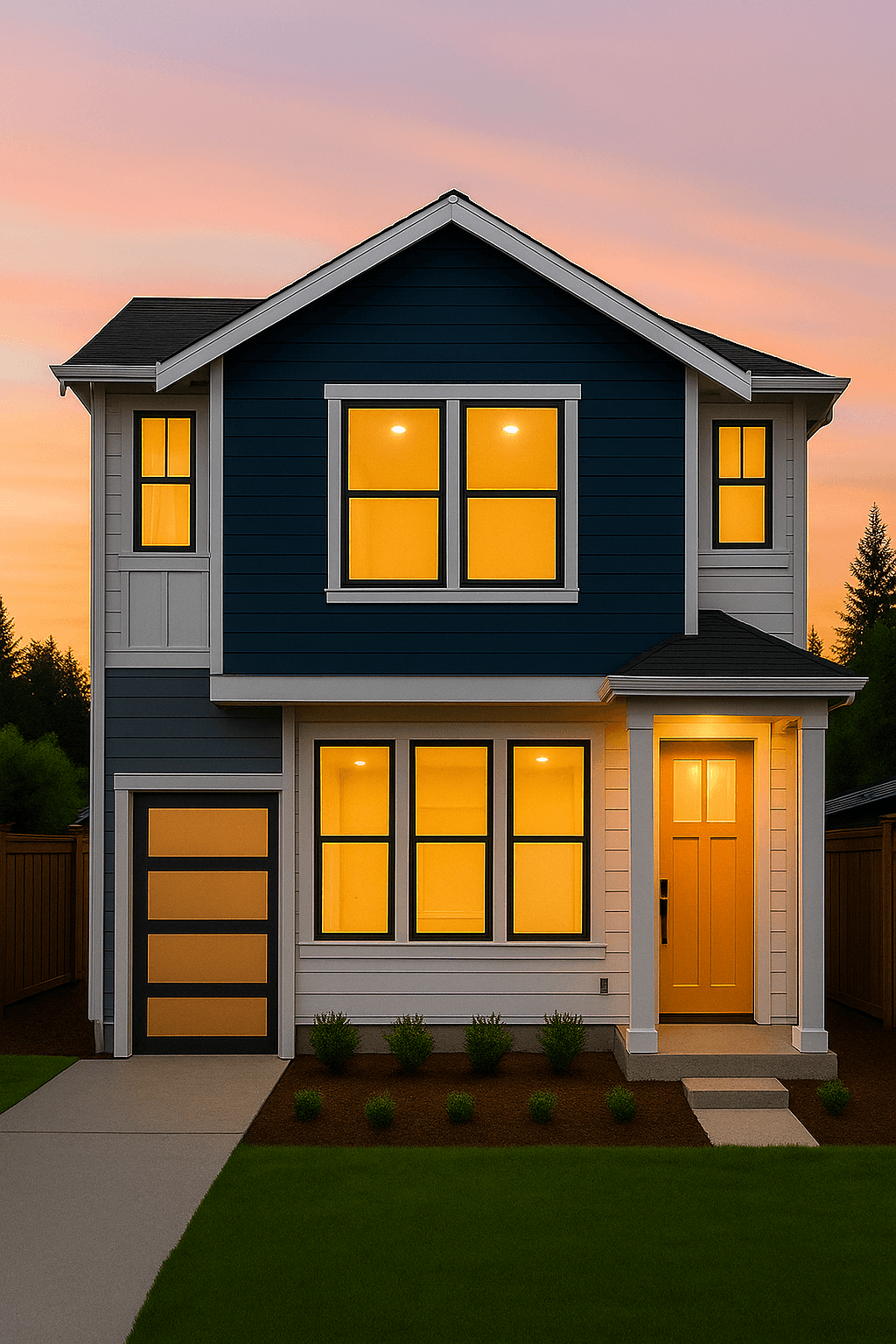

1-Unit New Build + Finished Basement

We purchased an off-market single-family home in West Seattle’s coveted North Admiral district, known for its charm, walkability, and strong resale demand. Our strategy: build a brand-new standalone unit on the lot and finish the basement of the main home to unlock additional livable space and maximize its exit price. The result? Both properties sold above expectations, delivering a 35%+ return to investors in under 15 months.

Development

13 months

“Both homes sold for more than I expected — and seeing a 35%+ return in just over a year was incredible. I’m already waiting for the next deal.”

1-Unit New Build + Finished Basement

We purchased an off-market single-family home in West Seattle’s coveted North Admiral district, known for its charm, walkability, and strong resale demand. Our strategy: build a brand-new standalone unit on the lot and finish the basement of the main home to unlock additional livable space and maximize its exit price. The result? Both properties sold above expectations, delivering a 35%+ return to investors in under 15 months.

Development

13 months

“Both homes sold for more than I expected — and seeing a 35%+ return in just over a year was incredible. I’m already waiting for the next deal.”

1-Unit New Build + Finished Basement

We purchased an off-market single-family home in West Seattle’s coveted North Admiral district, known for its charm, walkability, and strong resale demand. Our strategy: build a brand-new standalone unit on the lot and finish the basement of the main home to unlock additional livable space and maximize its exit price. The result? Both properties sold above expectations, delivering a 35%+ return to investors in under 15 months.

Development

13 months

“Both homes sold for more than I expected — and seeing a 35%+ return in just over a year was incredible. I’m already waiting for the next deal.”

Airbnb Investment near Olympic National Park

We acquired and transformed a property near the entrance of Olympic National Park, designing it to be a top 5% performer in the market. From interior design to full setup and operations management, our team handled everything end-to-end to create a truly hands-off, cash-flowing asset. In its first year, the property delivered an impressive 40% cash-on-cash return, cash-flowed every single month, and generated substantial tax savings through a cost segregation study

Airbnb Investment

3 Months

This property has been a game-changer — steady monthly income, incredible tax savings, and a 40%+ return in year one. I can’t wait for the next Airbnb deal.”

Airbnb Investment near Olympic National Park

We acquired and transformed a property near the entrance of Olympic National Park, designing it to be a top 5% performer in the market. From interior design to full setup and operations management, our team handled everything end-to-end to create a truly hands-off, cash-flowing asset. In its first year, the property delivered an impressive 40% cash-on-cash return, cash-flowed every single month, and generated substantial tax savings through a cost segregation study

Airbnb Investment

3 Months

This property has been a game-changer — steady monthly income, incredible tax savings, and a 40%+ return in year one. I can’t wait for the next Airbnb deal.”

Airbnb Investment near Olympic National Park

We acquired and transformed a property near the entrance of Olympic National Park, designing it to be a top 5% performer in the market. From interior design to full setup and operations management, our team handled everything end-to-end to create a truly hands-off, cash-flowing asset. In its first year, the property delivered an impressive 40% cash-on-cash return, cash-flowed every single month, and generated substantial tax savings through a cost segregation study

Airbnb Investment

3 Months

This property has been a game-changer — steady monthly income, incredible tax savings, and a 40%+ return in year one. I can’t wait for the next Airbnb deal.”

Testimonials

Testimonials

Testimonials

Our Investors

Discover how our investors achieved 20%+ returns while staying completely passive. Build wealth & buy back your time.

FAQs

FAQs

FAQs

Answering your questions

Answering your questions

Answering your questions

Got more questions? Message us!

Got more questions? Message us!

Got more questions? Message us!

What kind of returns should I expect, and over what timeline?

Our target is 20% annualized returns, depending on the project type. Development deals typically run 12–18 months, while cash-flowing short-term rentals start producing monthly distributions within 30–60 days of launch.

Who can invest with you? Are you open to non-accredited investors?

Right now, our opportunities are open to accredited investors — high earners and sophisticated investors who meet SEC guidelines.

What’s your track record on past projects?

We’ve consistently delivered 20%+ investor returns on our development projects and built a top 5% short-term rental portfolio that cash-flows every month. Every project is fully managed — from permitting and design to operations — so you stay passive and just watch the results roll in.

How do I know my capital will be handled safely and transparently?

Investor capital is held in dedicated project accounts with clear reporting and regular updates. We co-invest in every deal, so your money is always aligned with ours. Transparency is core to our process — you’ll always know where your project stands.

What types of investments does Second Bridge Associates focus on?

We focus on high-yield, operator-managed real estate deals designed to build wealth without adding work to your calendar. This includes: New construction + value-add development to unlock hidden equity Short-term rentals in high-demand markets with professional design + management

How do you find and evaluate your deals?

We go beyond the MLS. Our team sources off-market opportunities through brokers, wholesalers, and direct-to-seller outreach. Every deal goes through rigorous underwriting, stress-tested construction budgets, and a deep review of comps before we move forward.

What’s your process for working with new investors or operators?

We start with a short onboarding call to understand your goals, then share our upcoming opportunities. Once you invest, you’ll receive regular updates, detailed financials, and transparent communication at every stage — no guesswork, just clarity.

What kind of returns should I expect, and over what timeline?

Our target is 20% annualized returns, depending on the project type. Development deals typically run 12–18 months, while cash-flowing short-term rentals start producing monthly distributions within 30–60 days of launch.

Who can invest with you? Are you open to non-accredited investors?

Right now, our opportunities are open to accredited investors — high earners and sophisticated investors who meet SEC guidelines.

What’s your track record on past projects?

We’ve consistently delivered 20%+ investor returns on our development projects and built a top 5% short-term rental portfolio that cash-flows every month. Every project is fully managed — from permitting and design to operations — so you stay passive and just watch the results roll in.

How do I know my capital will be handled safely and transparently?

Investor capital is held in dedicated project accounts with clear reporting and regular updates. We co-invest in every deal, so your money is always aligned with ours. Transparency is core to our process — you’ll always know where your project stands.

What types of investments does Second Bridge Associates focus on?

We focus on high-yield, operator-managed real estate deals designed to build wealth without adding work to your calendar. This includes: New construction + value-add development to unlock hidden equity Short-term rentals in high-demand markets with professional design + management

How do you find and evaluate your deals?

We go beyond the MLS. Our team sources off-market opportunities through brokers, wholesalers, and direct-to-seller outreach. Every deal goes through rigorous underwriting, stress-tested construction budgets, and a deep review of comps before we move forward.

What’s your process for working with new investors or operators?

We start with a short onboarding call to understand your goals, then share our upcoming opportunities. Once you invest, you’ll receive regular updates, detailed financials, and transparent communication at every stage — no guesswork, just clarity.

What kind of returns should I expect, and over what timeline?

Our target is 20% annualized returns, depending on the project type. Development deals typically run 12–18 months, while cash-flowing short-term rentals start producing monthly distributions within 30–60 days of launch.

Who can invest with you? Are you open to non-accredited investors?

Right now, our opportunities are open to accredited investors — high earners and sophisticated investors who meet SEC guidelines.

What’s your track record on past projects?

We’ve consistently delivered 20%+ investor returns on our development projects and built a top 5% short-term rental portfolio that cash-flows every month. Every project is fully managed — from permitting and design to operations — so you stay passive and just watch the results roll in.

How do I know my capital will be handled safely and transparently?

Investor capital is held in dedicated project accounts with clear reporting and regular updates. We co-invest in every deal, so your money is always aligned with ours. Transparency is core to our process — you’ll always know where your project stands.

What types of investments does Second Bridge Associates focus on?

We focus on high-yield, operator-managed real estate deals designed to build wealth without adding work to your calendar. This includes: New construction + value-add development to unlock hidden equity Short-term rentals in high-demand markets with professional design + management

How do you find and evaluate your deals?

We go beyond the MLS. Our team sources off-market opportunities through brokers, wholesalers, and direct-to-seller outreach. Every deal goes through rigorous underwriting, stress-tested construction budgets, and a deep review of comps before we move forward.

What’s your process for working with new investors or operators?

We start with a short onboarding call to understand your goals, then share our upcoming opportunities. Once you invest, you’ll receive regular updates, detailed financials, and transparent communication at every stage — no guesswork, just clarity.

Contact

Contact

Contact

let's chat

Whether you're an investor, a real estate agent, or a developer - Second Bridge can help.